SGFinDex

Empowering your financial journey with SGFinDex

-

SGFinDex is a platform that lets you see your financial information (bank accounts, CPF balance, etc.) from different institutions in one place.

-

Provides a single view of your finances across government agencies and financial institutions.

-

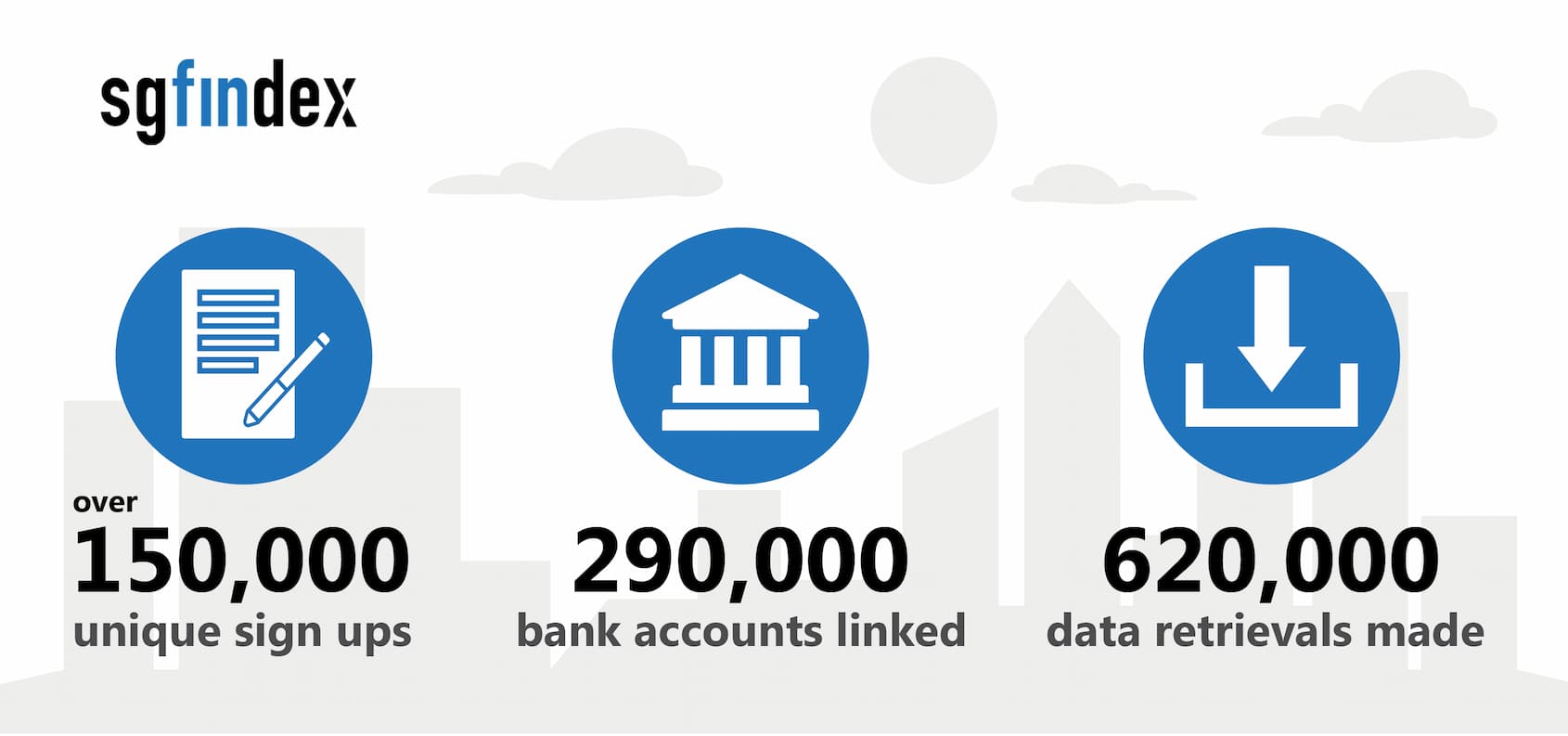

To date, SGFinDex has 150,000 users, connected 290,000 bank accounts and facilitated 620,000 data retrievals.

As you progress in your financial planning journey, you’ll likely sign up for accounts with different financial institutions to achieve your varied savings, investment and insurance goals. Before, reviewing your entire financial portfolio would have been a cumbersome task, as there was no ecosystem to facilitate data sharing among government agencies and financial institutions.

But that has changed today. SGFinDex is a joint initiative by the Monetary Authority of Singapore (MAS) and the Smart Nation and Digital Government Group (SNDGG) in collaboration with The Association of Banks in Singapore and seven participating banks. It is the world’s first public digital infrastructure that uses a national digital identity to allow individuals to manage and access financial information held across different government agencies and financial institutions.

To date, SGFinDex has 150,000 users, connected 290,000 bank accounts and facilitated 620,000 data retrievals.

Why use SGFinDex?

All your finances at a glance!

Benefits of using SGFinDex

For its effectiveness in assisting citizens with their digital management of financial accounts and planning, SGFinDex has won the following awards:

-

IMDA ASEAN Digital Awards (Digital Innovation, Bronze) — SGFinDex (2024)

-

Inspire Tech Awards — Most Innovative Use of Data for Digital Transformation (Southeast Asia)(2021)

-

Public Sector Transformation Awards (One Public Sector Award) — SGFinDex (2021)

How to use SGFinDex?

-

Log in to any of the participating organisations’ applications/websites or MyMoneySense, and navigate to SGFinDex.

-

Authenticate using Singpass.

-

Select the financial institution you wish to connect, and provide authorisation at its portal.

-

Financial information from government agencies are already connected.

-

Synchronise the data on a monthly basis to view your latest balance sheet.

Public Service Advisory on Data Privacy

SGFinDex does not read or store any of your financial information. It only transmits information across different organisations.

To protect your data privacy, data refresh will only take place when you give consent to data pulling.

You will retain control over what you wish to share and can withdraw consent to sharing data anytime.

Organisations participating in SGFinDex

Banks

With major banks such as Citibank, DBS/POSB, HSBC, Maybank, OCBC, SGXGroup, Standard Chartered, and UOB forming a part of the SGFinDex ecosystem, you can easily check your personal cash flow statements.

This way, you'll know if you need to contribute more to your rainy day fund or set aside more for your retirement fund.

Insurance companies

Great Eastern, HSBCLife, Income Insurance, Manulife Singapore, Prudential, and Singlife have joined SGFinDex.

Keep track of your lifelong insurance and investment policies to determine if you need to enhance your coverage.

MyMoneySense

SGFinDex is powered by MyMoneySense. With this nifty financial dashboard, you can get an overview of your wealth, cash flow and current protection plans.